Attention: Accredited Investors

For long-term investors who want to rise above volatility.

The Buffett-Inspired Approach: Minimize real risk and maximize returns with our investment strategy, grounded in the wisdom of Warren Buffett.

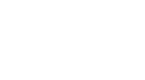

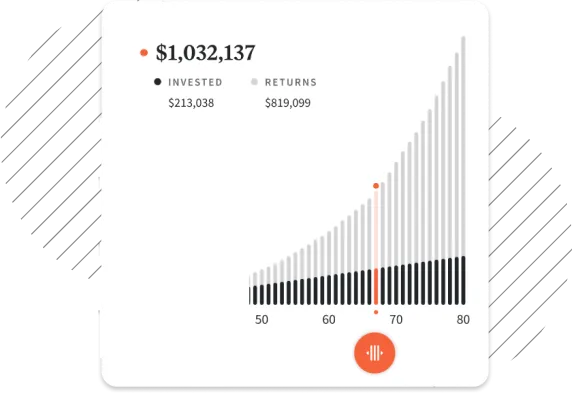

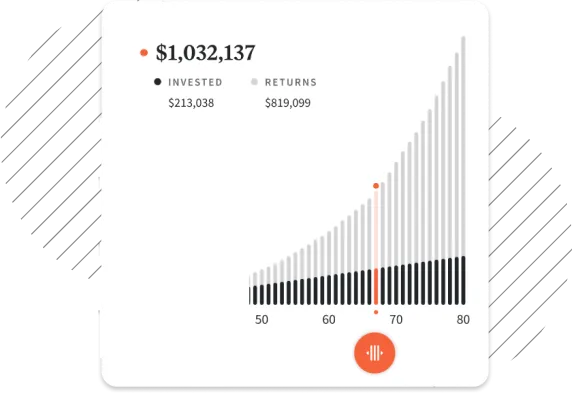

OUR HISTORICAL CLIENT RETURNS

Disciplined investing, even when public markets falter.

As we face ongoing stock market volatility, Alphyn Capital maintains a disciplined approach. As we believe that this positions us to compound effectively over the long term, despite inevitable swings in the market.

This is the approach we take with our flagship Master Portfolio. Additionally we can diversify your account by investing in carefully selected funds that have historically outperformed the S&P500, as well as income strategies featuring top-tier alternative investment funds and dividend ETFs for enhanced earning potential.

Built to help Investors invest without compromise.

At Alphyn Capital, our investment strategy centers around harnessing the power of long-term compounding, which has been referred to as the "eighth wonder of the world" by the renowned physicist, Albert Einstein. Our approach is to invest in high-quality publicly traded companies that have the potential to reinvest their cashflows at high rates of return over extended periods, thereby fueling growth and generating significant value for our investors.

The new way of investing.

Business owners mindset

Business owners mindset towards investments we analyze operational details to Identify Investment opportunities and risk. An

approach developed from meaningful lessons learned from 25 years of managing money and owning and operating family businesses.

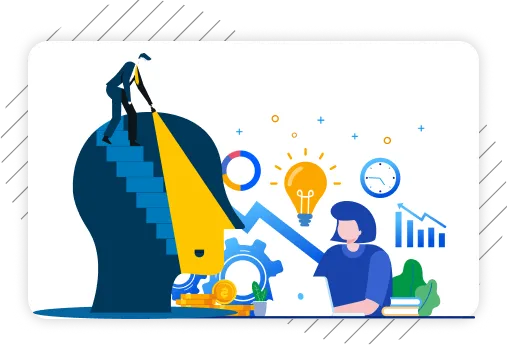

Clear, transparent fees

The fees that you pay can significantly affect your overall profits. While many fund managers charge performance fees to qualified customers, we only charge a flat 1% of assets under management.

Synthetic leverage Formula

We harness the power of synthetic leverage to identify lucrative investment opportunities while minimizing risk. Our sophisticated formula uncovers well-managed, publicly traded companies that skillfully employ synthetic leverage to amplify returns without increasing their debt burden. Capitalizing on the strategies of industry giants like Warren Buffet's Berkshire Hathaway. Our fund's approach and vigilant risk management allow us to deliver attractive returns for our investors

Unprecedented simplicity

Schedule a personal consultation call within minutes, and get a presentation on the strategy.

After that, freely decide if you’re going to open an account, and watch as your dollars are diversified across a series of investment funds with the goal of evolving your wealth.

It’s easy to get started.

Schedule a 30 min discovery call and get acquainted with the fund manager. Get presented with an investment plan to your specific needs and decide if you’re going to open an account.

Discovery call.

Pick a time and

schedule a call.

Tell us about yourself.

We’ll suggest a strategy that best fits your goals.

Grow your portfolio over time.

Benefit from both equity growth and income strategy.

MEET THE FOUNDER:

SAMER HAKOURA

Prior to founding Alphyn Capital Management, Samer Hakoura worked at his family's investment office in London and then managed various family investments, including a $70 million revenue business that he helped grow and sell.

Samer started his career at Deutsche Bank in London, taking part in over $11 billion in M&A and financing transactions. Samer holds an MBA from the Wharton School of Business and an MCHEM from Oxford University.

With more than 70% of the Founder’s liquid net worth invested in our investment strategy,* Alphyn Capital demonstrates solid conviction and alignment with clients’ interests.

Invest with clarity and confidence

Investor support

Easily connect with a personal market professional, and get answers to any questions you may have.

Insights and education

Insights on the private market & investing resources from Samer Hakoura.

Buffett-Inspired Approach

Focus your investments and discover potential returns with carefully planned and executed investing.

Still Have Questions?

WHAT SERVICES DO YOU OFFER?

We believe in focus and specialization. Don’t try to be jack of all trades etc.

Distilled 25 years of experience in markets and business into two primary portfolios. The ACML Master portfolio is a carefully chosen portfolio of approximately 20 stocks. The strategy behind is based on the observation that Warren Buffet became successful by using “synthetic leverage” or non-recourse debt to enhance returns at Berkshire Hathaway. The portfolio effectively tries to find 15-20 stocks that are similar to Berkshire Hathaway in that regard: companies that have advantaged business models and can safely leverage alternative third-party capital or operations to generate significant incremental cashflows, which can be reinvested at high rates of return over long runways. ACML believes such companies can compound in value over many years, especially when run by talented managers who are aligned with shareholders.

The ACML Advantage portfolio is a more rounded total portfolio comprising 1) highly selected equity funds that have outperformed the S&P 500 for growth, 2) income strategies comprising dividend ETFS and top-tier alternative investment funds from brand name managers offering potential for enhanced income opportunities.

WHY SHOULD I PAY YOU TO INVEST FOR ME WHEN I CAN INVEST IN PASSIVE INDEX FUNDS?

Passive indices prevent value discrimination. They are forced to buy every company in the index, regardless of performance. They do not differentiate winners from losers, and instead blindly allocate based on index weights. There is little diligence or intelligent capital allocation.

WHY SHOULD I PAY TO YOU TO INVEST FOR ME WHEN I CAN DIY

Long-term success in the stock market requires a disciplined and thoughtful approach, applied consistently, for years on end. Especially during times of volatility, most investors find it hard to stick with a strategy.

HOW DO I KNOW I CAN TRUST YOU

Your assets are custodied with Charles Schwab, the largest brokerage in the US. As a registered investment advisor, we have fiduciary duty towards our clients. You have full access and transparency to your accounts and are able to see all your holdings at any time through your online portal.

WHAT ARE YOUR RETURNS LIKE?

Past performance is no guarantee of future returns. However, we publish the ACML Master portfolio returns on a quarterly basis, and for the ACML advantage portfolio, we select funds that have historically out performed, net of fees, a mix of the SPDR S&P 500 ETF and Vanguard Total Bond Market ETF over multi-year periods.

HOW DO YOU HANDLE MARKET DRAWDOWNS?

We invest in carefully selected companies that we believe are robust and high quality, in strong business models and a history of attractive growth. We are also disciplined of the way we invest, taking advantage of market drawdowns to buy more high quality assets cheaply! Through the ACML Advantage portfolio we offer select private funds that can provide diversification and that are potentially less impacted by general market volatility.

ABOUT

CONTACT US

DISCLAIMER

© 2019-23 Alphyn Capital Management | All Rights Reserved

Powered By Luxvoni.com Where Boundaries Are Not Included.